Asset Backed Cryptocurrency vs Traditional Stablecoins: Which Is Better for Your Cross-Border Payments?

- Mark Dormer

- Nov 1

- 5 min read

The global payments landscape is undergoing a massive transformation. While traditional stablecoins have made headlines for simplifying cross-border transfers, a new generation of asset-backed cryptocurrencies is emerging to address their fundamental limitations. At TRNZND, we're pioneering this next evolution: creating not just faster payments, but a complete reimagining of how digital currency can drive both financial inclusion and meaningful social impact.

But what's the real difference between traditional stablecoins and asset-backed cryptocurrencies like TRNZND? And more importantly, which one delivers better results for your cross-border payment needs?

Understanding Traditional Stablecoins

Traditional stablecoins maintain their stability through centralized reserves of fiat currency: typically USD or EUR: held by the issuing entity. Think of them as digital IOUs backed by cash sitting in bank accounts. Popular examples include USDC and USDT, which promise a 1:1 peg to the US dollar through their reserve holdings.

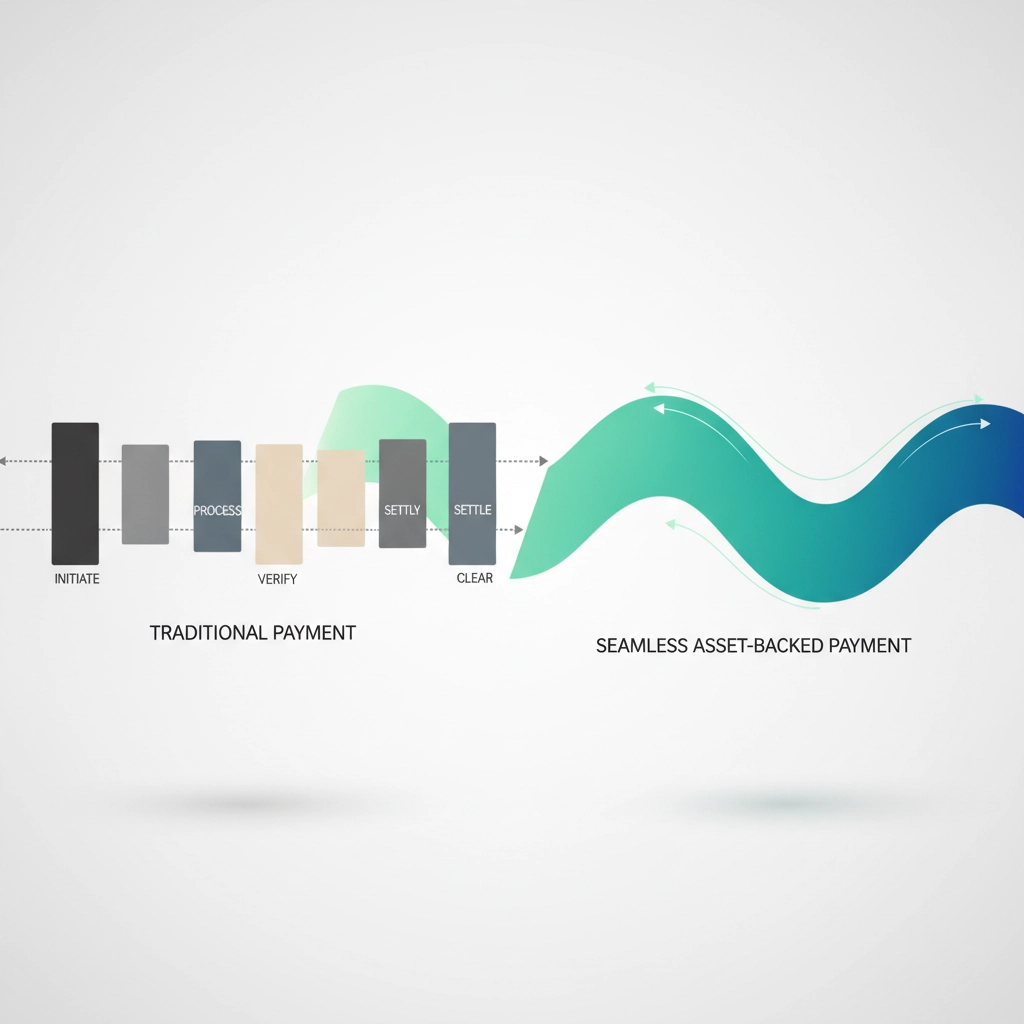

These fiat-backed stablecoins offer clear advantages over traditional banking: near-instant settlement, 24/7 availability, and dramatically lower fees. A wire transfer that might take 3-5 business days and cost $50+ can be replaced with a stablecoin transaction that settles in minutes for under $5.

However, traditional stablecoins come with significant limitations. They're entirely dependent on centralized entities maintaining adequate reserves, creating single points of failure. Regulatory changes can impact accessibility overnight. Most critically, they offer no mechanism for addressing the broader challenges facing global payments: like supporting underbanked populations or funding sustainable development initiatives.

The TRNZND Difference: Asset-Backed Cryptocurrency Revolution

Asset-backed cryptocurrencies represent a fundamental evolution beyond traditional stablecoins. Rather than relying solely on fiat reserves, TRNZND's approach combines robust asset backing with integrated social impact mechanisms and advanced stability features designed for real-world utility.

TRNZND operates on a revolutionary model that addresses three critical gaps in existing cross-border payment solutions:

1. Enhanced Stability Through Diversified Asset Backing While traditional stablecoins depend on single-currency reserves, TRNZND utilizes a sophisticated backing mechanism that reduces exposure to any single point of failure. This approach provides superior protection against currency volatility and regulatory disruption.

2. Integrated Social Impact Framework Every TRNZND transaction contributes to a transparent fund supporting UN Sustainable Development Goals. Users aren't just making payments: they're actively participating in solutions for education, healthcare, clean water, and economic development in emerging markets.

3. Community Governance and Ownership Unlike centralized stablecoins controlled by corporate entities, TRNZND incorporates community governance features. Early supporters gain voting rights on social impact cause selection and benefit from exclusive airdrop opportunities across TRNZND's expanding ecosystem.

Cross-Border Payment Performance Comparison

When evaluating payment solutions, the metrics that matter most are speed, cost, accessibility, and reliability. Here's how TRNZND stacks up against traditional stablecoins:

Settlement Speed and Availability Both TRNZND and traditional stablecoins operate 24/7 with settlement times measured in minutes rather than days. However, TRNZND's architecture is optimized for emerging market accessibility, ensuring reliable performance even in regions with limited financial infrastructure.

Transaction Costs and FX Volatility Protection Traditional international transfers through correspondent banking networks can lose 6-10% of value through fees and unfavorable exchange rates. Traditional stablecoins reduce this to network fees (typically under $5), but TRNZND goes further by providing enhanced FX volatility protection through its asset-backing mechanism.

Real-World Impact and Sustainability This is where the difference becomes stark. Traditional stablecoins are purely transactional: they move money efficiently but contribute nothing to broader economic development. TRNZND transforms every payment into a force for positive change, with transparent tracking of social impact contributions.

Use Cases Where TRNZND Excels

International Business Operations A manufacturing company importing goods from Southeast Asia faces constant FX volatility risk and high transfer costs. Traditional stablecoins solve the speed and cost issues but don't address volatility protection. TRNZND's asset-backed model provides enhanced stability while simultaneously funding education and infrastructure projects in the regions where the company operates.

Family Remittances to Emerging Markets Consider a family sending $500 monthly from London to relatives in rural Kenya. Traditional bank transfers might cost $35+ and take several days. Fiat-backed stablecoins reduce costs to under $5 and enable instant settlement, but require reliable local exchange infrastructure. TRNZND not only provides these benefits but ensures a portion of each transfer supports local development projects: creating a positive feedback loop that strengthens the communities receiving remittances.

Cross-Border E-commerce An online retailer serving customers across Africa and Southeast Asia needs payment solutions that work reliably across diverse regulatory environments. TRNZND's asset-backed approach provides stability advantages while its social impact framework helps build goodwill and trust in local markets.

Why Asset-Backed Architecture Matters

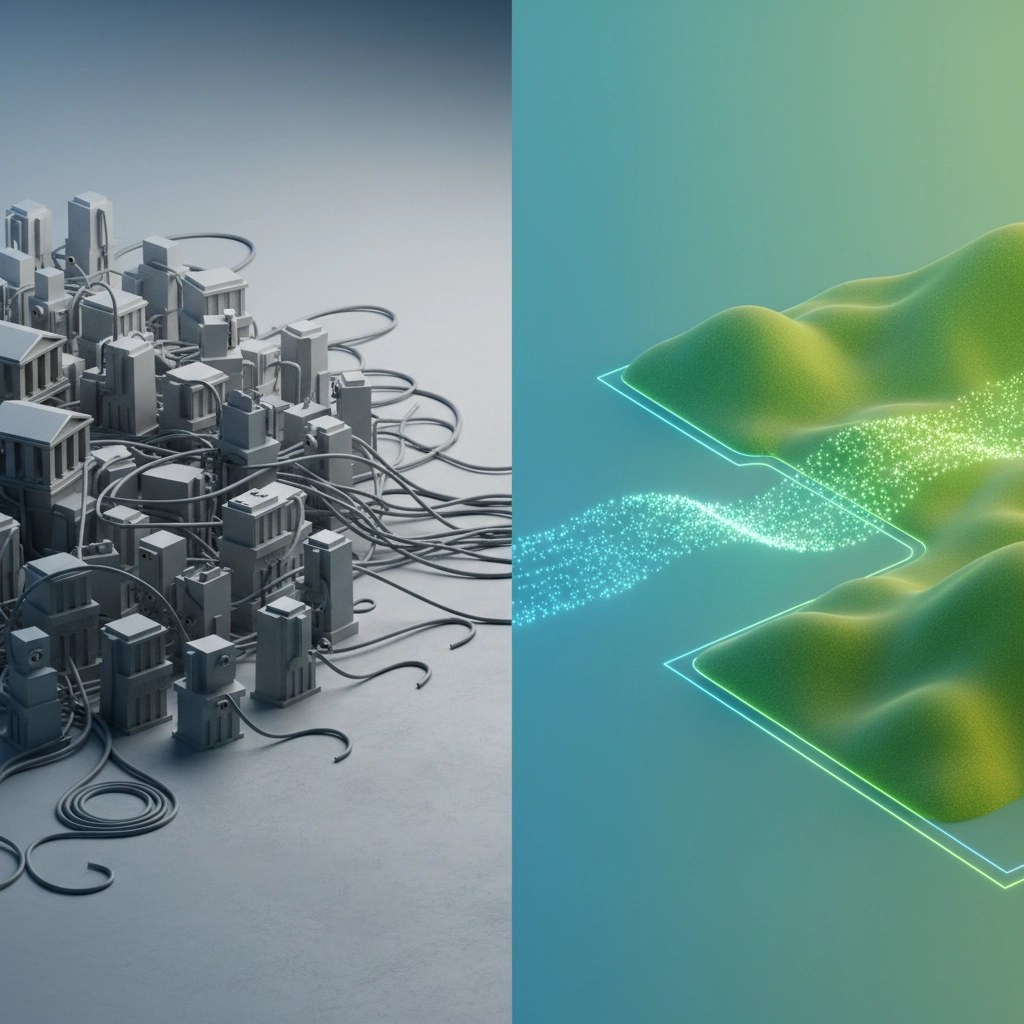

The fundamental problem with traditional stablecoins isn't their technology: it's their narrow focus on replicating existing financial systems rather than improving them. TRNZND's asset-backed approach addresses this by creating inherent value beyond mere payment facilitation.

Traditional stablecoins are essentially digital representations of existing currencies. They're faster and cheaper than wire transfers, but they don't solve underlying issues like financial exclusion, currency instability in emerging markets, or the lack of investment in sustainable development.

TRNZND's asset-backed model creates a new category of value-generating digital currency. Every transaction strengthens the ecosystem, contributes to social impact, and builds toward a more inclusive global economy.

Security and Regulatory Advantages

Asset-backed cryptocurrencies like TRNZND offer superior risk distribution compared to traditional stablecoins. Instead of concentrated exposure to single reserve currencies or centralized management risks, the asset-backing approach spreads risk across diverse, productive assets.

From a regulatory perspective, TRNZND's social impact integration provides a compelling narrative for policymakers. Rather than viewing cryptocurrency as purely speculative, regulators see demonstrable community benefits and transparent impact tracking.

The Network Effect of Social Impact

Perhaps most importantly, TRNZND's integrated social impact creates powerful network effects that traditional stablecoins can't match. As more users adopt TRNZND for cross-border payments, the social impact fund grows, enabling larger and more meaningful development projects. This creates positive cycles that benefit both users and recipients in ways that pure payment tokens cannot achieve.

Early adopters recognize this potential. That's why TRNZND offers early donors exclusive voting rights on social impact cause selection plus amazing airdrops from TRNZND and other associated projects in our growing ecosystem.

The Future of Cross-Border Payments

Traditional stablecoins solved the immediate problems of slow, expensive international transfers. But they represent incremental improvement rather than transformational change. Asset-backed cryptocurrencies like TRNZND represent the next evolution: payment systems that don't just move money efficiently, but actively contribute to building a more equitable and sustainable global economy.

For businesses, families, and organizations making cross-border payments, the choice is becoming clear. Traditional stablecoins offer basic efficiency improvements. TRNZND offers the same efficiency benefits plus enhanced stability, integrated social impact, and community ownership in the future of global finance.

The question isn't whether digital currencies will replace traditional cross-border payment methods: that transition is already underway. The question is whether we'll settle for digital versions of existing systems, or embrace solutions that use technology to create genuine positive change.

At TRNZND, we believe the future demands more than just faster payments. It demands payment systems that build a better world with every transaction. That's the difference between traditional stablecoins and asset-backed cryptocurrencies. That's the TRNZND difference.

Ready to be part of this transformation? Visit TRNZND.io and discover how your cross-border payments can drive meaningful change while delivering superior performance. Join our community of early adopters who are shaping the future of global finance: and securing exclusive benefits along the way.

Comments