Crypto for Emerging Markets: 5 Ways Asset-Backed Digital Currency Is Solving Real-World Problems

- Mark Dormer

- Oct 28

- 6 min read

The global financial system has long failed emerging markets, leaving billions of people without access to basic banking services, stable currencies, or affordable payment solutions. Traditional banking infrastructure is often unreliable, expensive, and exclusionary in these regions. However, asset-backed digital currencies are emerging as a powerful force for change, offering innovative solutions to age-old problems that have hindered economic growth and individual prosperity.

Asset-backed digital currencies, including stablecoins pegged to stable assets like the US dollar and tokenized real-world assets, represent a fundamental shift in how financial services can be delivered. Unlike volatile cryptocurrencies, these digital assets maintain stable value by being backed by tangible reserves, making them practical tools for everyday commerce and savings.

From Nigeria to the Philippines, from Kenya to El Salvador, these technologies are already transforming lives and businesses. Let's explore five critical ways asset-backed digital currencies are addressing real-world challenges in emerging markets.

1. Revolutionizing Cross-Border Payments and Remittances

Cross-border payments remain one of the most expensive and inefficient aspects of the global financial system, particularly for people in emerging markets. Traditional remittance services charge fees ranging from 5% to 15% of the transfer amount, while transfers can take days or even weeks to complete.

Asset-backed digital currencies are dramatically reducing these barriers. When a Filipino overseas worker sends money home using USD Coin (USDC), the transaction typically costs less than $1 and completes within minutes. This represents savings of hundreds of dollars annually for families who rely on these transfers for basic needs like food, education, and healthcare.

Consider the case of Maria, a domestic worker in Dubai who sends $200 monthly to her family in Manila. Using traditional banking, she would pay approximately $20 in fees and wait 3-5 business days for the transfer. With stablecoin remittances through mobile money platforms, she pays less than $2 and her family receives the funds almost instantly.

Money transfer organizations across Africa and Asia are increasingly adopting stablecoin rails to offer competitive services. Companies like Chipper Cash in Africa and GCash in the Philippines have integrated stablecoins into their platforms, enabling millions of users to send and receive international payments at a fraction of traditional costs.

The impact extends beyond individual families. Small businesses engaged in international trade can now pay suppliers and receive payments without the delays and fees associated with correspondent banking networks. This improved cash flow enables better inventory management and business growth.

2. Providing Currency Stability in High-Inflation Economies

Hyperinflation and currency devaluation have devastated savings and economic planning across numerous emerging markets. In countries like Turkey, Argentina, and Lebanon, local currencies have lost 50% or more of their value in single years, wiping out the life savings of millions.

Asset-backed stablecoins offer a lifeline by providing access to stable, dollar-denominated digital assets. Citizens can convert their volatile local currency into USD-pegged stablecoins, effectively creating digital dollar savings accounts that preserve purchasing power.

In Argentina, where inflation exceeded 100% in 2023, tech-savvy citizens increasingly use stablecoins as a hedge against peso devaluation. Local exchanges report that stablecoin trading volumes often exceed traditional cryptocurrency volumes, indicating their use as practical financial tools rather than speculative investments.

The Turkish lira's dramatic decline led to widespread adoption of stablecoins among young professionals and small business owners. By holding USDC or USDT, they can maintain the purchasing power of their savings and protect against further currency depreciation. This has created a informal dollarization of savings without requiring access to US banking systems.

Small businesses particularly benefit from this stability. A textile manufacturer in Istanbul can quote prices to international clients in stablecoins, eliminating foreign exchange risk and enabling more predictable profit margins. This stability encourages international trade and business expansion.

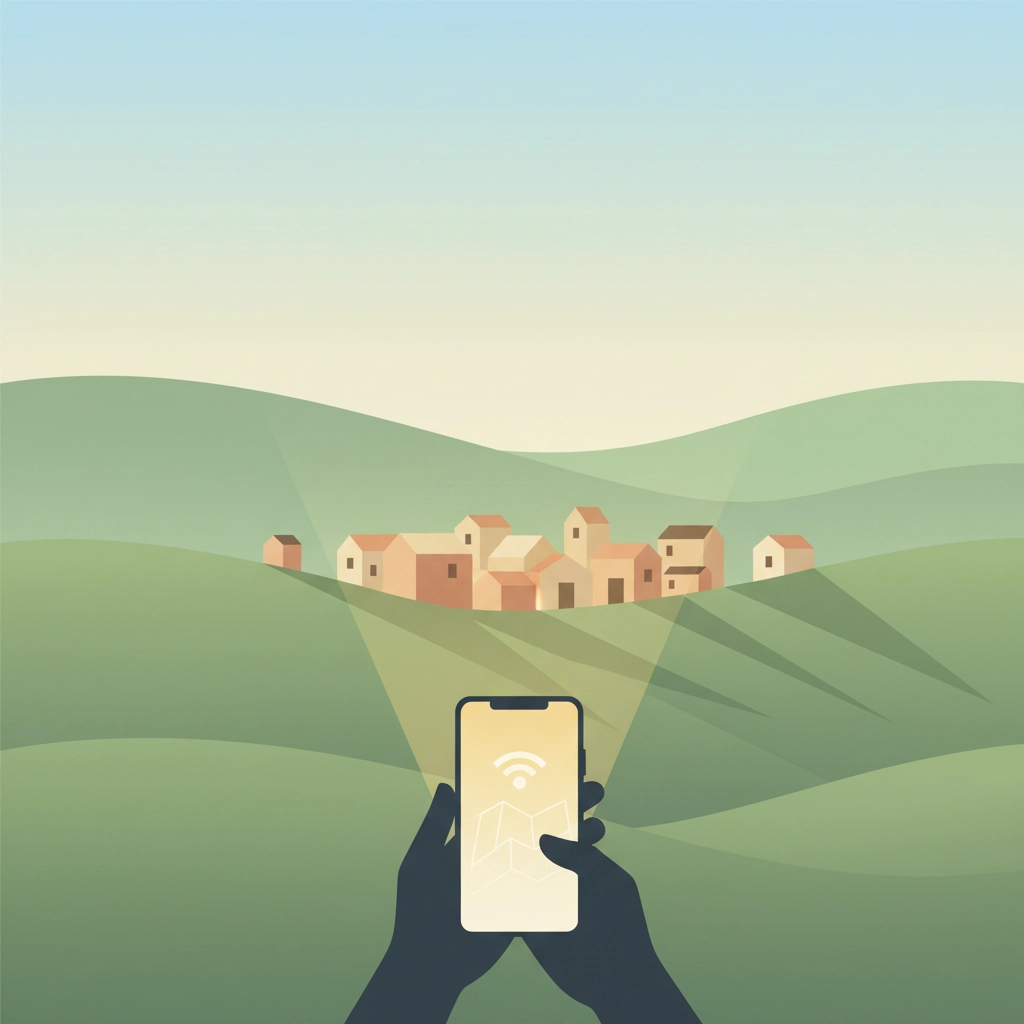

3. Expanding Financial Inclusion for the Unbanked

Over 1.7 billion adults worldwide lack access to traditional banking services, with the highest concentrations in emerging markets. Geographic isolation, documentation requirements, minimum balance thresholds, and institutional distrust keep millions excluded from formal financial systems.

Asset-backed digital currencies, accessible through basic smartphones, are bridging this gap. In Kenya, where M-Pesa pioneered mobile money, stablecoin integration is bringing dollar-denominated savings to rural communities for the first time.

Consider the example of coffee farmers in remote Colombian villages. Previously, they had no access to banking services and stored value in physical assets or local currencies. Now, through mobile wallets supporting stablecoins, they can receive payments directly from international buyers, save in stable currencies, and access credit using their tokenized coffee inventory as collateral.

Digital identity solutions built on blockchain technology are also addressing documentation barriers. In regions where birth certificates or government IDs are difficult to obtain, blockchain-based identity systems enable people to establish financial identities and access services.

Microfinance organizations are leveraging stablecoins to reduce operational costs and expand their reach. By eliminating the need for physical bank branches and reducing transaction costs, they can serve smaller loans and reach more remote communities profitably.

Women, who face additional barriers to financial inclusion in many emerging markets, particularly benefit from mobile-first stablecoin solutions. They can save and transact privately without requiring permission from family members or traveling to distant bank branches.

4. Building Trust Through Transparency and Accountability

Weak institutions and corruption plague many emerging markets, eroding trust in traditional financial systems. Citizens who have experienced bank failures, currency confiscations, or fraudulent schemes are naturally skeptical of centralized financial institutions.

Blockchain technology's inherent transparency and immutability provide a foundation for rebuilding trust. Every transaction is recorded on a public ledger, making fraud and manipulation extremely difficult. This transparency is particularly valuable in contexts where institutional corruption is common.

In several African countries, stablecoin transactions are increasingly used for international trade precisely because they provide clear, auditable transaction histories. Import-export businesses can demonstrate compliance with trade regulations and tax obligations through blockchain records.

Smart contracts enable the creation of transparent savings and lending protocols that operate according to pre-programmed rules rather than human discretion. This eliminates many opportunities for corruption while ensuring consistent, fair treatment of all users.

Supply chain transparency is another critical application. When agricultural products are tracked using blockchain technology and payments made in stablecoins, farmers can prove the origin and quality of their products to international buyers, commanding premium prices for certified organic or fair-trade goods.

The transparency also extends to humanitarian aid and development funding. International organizations can track how donated funds are used, ensuring they reach intended beneficiaries rather than being diverted through corrupt channels.

5. Unlocking Value Through Real-World Asset Tokenization

Many people in emerging markets possess valuable assets: land, livestock, inventory, or equipment: but cannot easily convert these into liquid capital for investment or emergency needs. Traditional collateral systems are often inaccessible or require extensive documentation and legal processes.

Tokenization of real-world assets is revolutionizing access to credit and investment opportunities. By representing physical assets as digital tokens on blockchain networks, previously illiquid assets become tradeable and usable as collateral.

In Rwanda, smallholder farmers are tokenizing their coffee crops, enabling them to secure financing for the next planting season using their expected harvest as collateral. Investors from around the world can purchase tokens representing shares of these harvests, providing capital to farmers while earning returns tied to agricultural output.

Real estate tokenization is opening property investment to middle-class citizens who previously couldn't afford minimum investments. A construction worker in Mexico City can now own fractions of commercial properties in premium locations, diversifying their savings beyond traditional options.

Inventory financing for small businesses becomes much more efficient when goods are tokenized. A shop owner in Lagos can use their inventory as collateral for working capital loans without complex paperwork or lengthy approval processes. Smart contracts automatically manage the collateral and loan terms, reducing costs for both lenders and borrowers.

The global nature of blockchain networks means that tokenized assets can attract international investment and liquidity. A palm oil plantation in Indonesia can raise capital from investors in Europe or North America, bypassing limited local capital markets.

Art, collectibles, and cultural artifacts can also be tokenized, enabling artists and cultural institutions in emerging markets to access global collector networks and preserve cultural heritage through digital ownership records.

Looking Ahead: Challenges and Opportunities

While asset-backed digital currencies offer tremendous potential for emerging markets, several challenges remain. Regulatory uncertainty creates hesitation among potential users and service providers. Internet connectivity and smartphone penetration, while improving rapidly, still limit access in remote areas.

Education and financial literacy are critical for successful adoption. Many potential users need training on digital wallet security, private key management, and safe transaction practices. However, the same mobile networks that enabled rapid adoption of mobile money are proving effective channels for cryptocurrency education.

The convergence of asset-backed digital currencies, improved mobile infrastructure, and supportive regulatory frameworks is creating unprecedented opportunities for financial inclusion and economic growth in emerging markets. As these technologies mature and become more user-friendly, they promise to deliver on the original vision of cryptocurrency: a more inclusive, efficient, and equitable financial system for all.

The transformation is already underway, with millions of people gaining access to financial services, stable savings options, and global economic opportunities that were previously beyond their reach. Asset-backed digital currencies are not just technological innovations; they are tools for economic empowerment and human development in some of the world's most challenging environments.

Comments